In less than a century, the same economic and financial scenario keeps repeating itself. Since the crisis of 1929, passing through that of the 1980s and that of 2008, the world is more than ever at risk of experiencing a very severe economic and financial crisis. Coronavirus also identified under the name of COVID19 has only removed the cover of a fragile and similar situation of 1929.

In 1929 years of booming prosperity ended in catastrophe, it was the biggest stock market crash since records began. First time investors bought at huge amounts of money to speculate on the market. The market broke very sharply and a lot of people were wiped out with it. Later thousands of banks failed millions lost everything. The crash was followed by a depression that spread across the world lasted for a decade and was a prelude to war. Many years after should we relive the same story of a financial disaster that we hoped would never happen again?

Moments of ecstasy

Wednesday 23rd of October 1929 without warning share prices are plummeting on a New York Stock Exchange. Investors are stunned. For the last five years the market has only gone up. In the space of an hour a staggering two and a half million shares are sold. The next day the dome would spiral continues. Few of the thousands waiting in the crowd appreciated the scale of the disaster that was about to unfold. Nor could they imagine that over the next five days a financial catastrophe would sweep away the foundations of America’s prosperity. But to understand what brought about the crash we need to go back a decade to a time when American confidence grew so high that it seemed the good times would last forever. In 1919 the US had emerged victorious from World War one. A mood of optimism was in the air. Britain and its European allies were exhausting financially from the war. The US economy was thriving and the world danced to the American children. The uncertainties were over. There seemed little doubt about what was going to happen. America was going on the greatest ascension spree in history and there was going to be plenty to tell about it. In the 1920s, everyday life was changing. Electrification transformed America. Towns were hooked up to the grill. New technologies emerged: airplanes, radios, domestic goods that had started life as luxuries, now became necessities. The card industry also boomed as people flocked to buy one of the new Ford or Chrysler automobiles. An era of boundless prosperity seemed to have begun. This type of consumer credit was another innovation of the 1920s. For the first time the idea of buy now pay later hit the mainstream.

With easy credit and more disposable income, Americans were now looking for new ways to get even richer. Since World War one the US government had sold bonds known as Liberty bonds to pay for the war. This was a way to borrow money from the public who in turn would receive interest payments on the bonds volume. Celebrities such as Charlie Chaplin and Douglas Fairbanks had been recruited to promote them at huge rallies. Now there was another group of people who thought they could take advantage of this new investing culture, the bankers of Wall Street. For years Wall Street the center of American Finance was made up of a small elite group of bankers doing business with each other in a society closed off to the general public. But one man saw an opportunity that would change the face of the financial world. Charles Mitchell president of National City Bank spotted a lucrative the gap in the market. Mitchell was a natural salesman with a big ambition if people were willing to buy bonds to raise capital for the government surely they could be tempted to buy stocks and shares to raise capital for private companies listed on the New York Stock Exchange and they could make a profit for themselves in the process. The idea took off and to exploit this lucrative new market Mitchell opened brokerage offices all across the country where people who had the money but not the investment no ho could speculate in stocks and shares. Technology made it all possible. The latest share prices flashed from Wall Street could be printed out within minutes across America, using telegraphic ticker tape machines. By the mid 20s around three million Americans were in the market and Wall Street gripped the public imagination with tales of fortunes being made overnight. The idea of a great bull market where shares only seemed to go up took hold. The young comic actor Groucho Marx invested all his savings into the market and was so pleased with his profits on paper that he persuaded his brothers to invest too. But it wasn’t just celebrities becoming speculators, the big Wall Street speculators were becoming celebrities themselves. They were thought of as creative entrepreneurial and bringing wealth to America. Joseph Kennedy father of the future President Kennedy was one of this new breed of shrewd financial superstar. Stories circulated that anyone from bell boys to bobbins could make easy money on the market. The shoeshine boy on Wall Street Pat Bologna was one of those inspired by these tales of rags to riches. People had so much faith in the bull market that they borrowed increasing sums of money to speculate on rising share prices. This way of buying shares was known as buying on margin. The investor was required to put down only part of the money with their broker funding the rest. The culture of buy now pay later had spread to the stock market. This vast influx of borrowed money into the stock market created more demand for shares pushing prices ever upwards. In 1928, the market went up by almost 50 percent in just 12 months and as stocks continued to raise more and more investors borrowed money to get a piece of the action. One of them was shoeshine boy Pat Bologna. Wall Street was hungry for new punters. There was one group of would-be investors that the street had always ignored but whose money it now wanted.

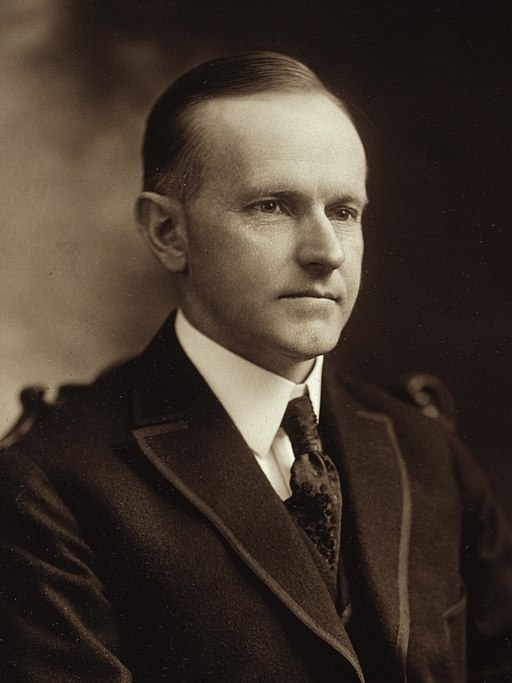

Throughout the Surrey market of the 1920s, the Republican Party stayed in power on the back of America’s increasing prosperity. Calvin Coolidge became president in 1923. An investor himself, he was notably silent on the speculative mania gripping Wall Street.

Bankers in control of the financial system

During the Coolidge presidency, Wall Street spark continued to grow unchecked. His administration had close links with an elite group of bankers and finances Wall Street’s inner circle. Their wealth and connections gave them immense influence over the government’s financial policy. The most prestigious of these elite firms was the JP Morgan bank. Strategically located directly opposite the stock exchange it would play a key role in events to come. A senior partner at JP Morgan Thomas Lamont was the most powerful man on Wall Street his influence extended well beyond New York. Lamont and the other JPMorgan partners spoke regularly with successive presidents. Under Lamont’s leadership, JPMorgan steered clear of the worst excesses of the stock market.

But the close relationship between elite bankers and politicians helped keep government regulation of Wall Street to a minimum. While amateur speculators were transfixed by the soaring value of their investments, they were hopelessly unaware of how Wall Street really worked. With little government supervision the market was a law unto itself. An insider dealing was rife. As smaller investors gambled with their life savings they failed to realize that the odds were stacked against them. Men like Joseph Kennedy did not make their fortunes by simply picking the right stocks. The truth was that they were cashing in on the naivety of gullible newcomers. In March of 1929, a new Republican President Herbert Hoover was inaugurated. In his address he reassured Americans: “we have reached a higher degree of comfort and security than ever existed before in the history of the world”. But behind the scenes he was less confident. In private Hoover talked of an orgy of speculation. But like his predecessor Coolidge he had no appetite for regulation of the marketplace. Yet, Hoover was not alone in his fears that the stock market bubble might be about to burst. Days after the inauguration speech a prominent and highly respected banker Paul Warburg broke ranks with the Wall Street aristocracy and issued a bleak warning: “if orgies of unrestrained speculation are permitted to spread too far, the ultimate collapse is certain to bring about a general depression involving the entire country.” Warburg’s prediction fell on deaf ears, and between May and September 1929, 60 new companies were floated in the New York Stock Exchange adding more than a hundred million shares to the marketplace fueling the investment bubble. Some professional speculator since that the market was overheating. The more astute got out during the summer. In September, the market became increasingly volatile. Behind closed doors President Hoover’s and ease was growing.

Moments of Truth

No one knows what triggered the sudden loss of confidence that happened at the end of Wednesday 23rd of October. But out of nowhere a sharp fallen automobile stocks provoked a frantic last hours trading. Millions of shares were suddenly sold. The next day the great crash of 1929 began. Desperate for news thousands gathered outside the stock exchange.

A visitor from Britain was there that day too. Winston Churchill had invested much of his own money in the US stock market and had decided to pay a visit: “I happened to be walking down Wall Street at the worst moment of the panic and the perfect stranger who recognized me invited me to enter the gallery of the stock exchange. I expected to see pandemonium but the spectacle that met my eyes was one of surprising calm and orderliness. The twelve hundred members of the stock exchange were walking to and fro like a slow-motion picture of a disturbed ant heap offering each other enormous blocks of securities at a third of their own prices.”

Churchill was to lose a fortune in the crash that day. Outside the crowds continued to wait for news rumors were fueling the mounting panic.

The bankers knew they had to do something to avert a total financial meltdown. Then a huge amount of the banker’s cash is injected with hope to get the market moving again. Over the weekend the banker’s interventionists seem to have worked trading on Friday and Saturday was calm and uneventful. President Hoover also tried to steady nerves by repeating a mantra that has been used during market crashes many times since. “The fundamental business of the country that is production and distribution of commodities is on a sound and prosperous basis”. But in the offices of the financial district there was total kills.

On Monday the stock tickers running out of tape panicking investors desperate for the latest share prices jammed the telephone lanes between New York and other major cities. For the first time, many speculators were discovering the downside of easy credit and buying on margin.

On Tuesday morning some of the most famous names in corporate America saw their share price plummet. US Steel, Radio, General Motors, stocks that had been symbols of the boom years. It’s estimated that by the end of these five days trading 25 billion dollars worth of personal wealth had simply disappeared.

The effects of the catastrophic crash and Wall Street were pulled out across America. Even those who had never owned shares and who’d never benefited from the stock market boom became victims too. The crash had undermined Americans faith and their fragile banking system made up of thousands of small-town banks at lack the size of repetition to convince customers that their money was safe. As confidence in the economy sank further, a domino effect began. In 1931 over 2,000 banks failed. The stock market crashed in 1929 did not create the Great Depression but it did start a sequence of events that eventually culminated with the Great Depression.

Paul Warburg, who so accurately predicted the crash and the depression, saved the bank he ran from disaster by getting out of the market and time. But it was of little consolation to him.

Redefining the rules of the game

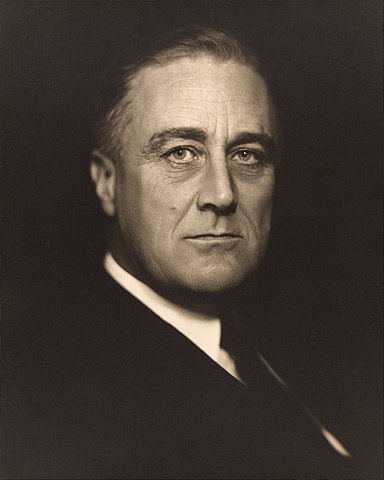

In 1932 twelve years of Republican rule came to an end. Democrat Franklin Roosevelt was elected president in a landslide victory. His first task was to restore confidence. Seen as a savior Roosevelt promised a new deal for the American people and to regulate the financial system. The new president acted quickly. He guaranteed bank deposits and introduced laws forcing bankers to operate on the strict government supervision.

An investigation into the crash was launched by the Senate Banking Committee. It would last more than three years and the 10,000 pages of testimony blackened the reputation of Wall Street. The committee’s ambitious lawyer Ferdinand Pakora challenged the banking elite to account for their behavior. In response to public outrage at the bankers’ dirty dealings, President Roosevelt set up the Securities and Exchange Commission its task to clean up Wall Street. At its head he chose a man who knew more about unethical practice than most.

Although Roosevelt restored confidence in the banking system the Great Depression would last until the outbreak of World War two. Then as now the globalized economy meant that the crash and subsequent depression rippled out across the world. In Britain there was a slump in manufacturing and millions lost their jobs. Germany still suffering from defeat in the First World War was hit even harder. So many people had their life savings destroyed during the Great Depression that had created in many countries a desire for some authoritarian government that would save them that would rescue the economy. No doubt that crash and the depression strengthened anti-capitalist movements. While communism and fascism prospered many nations put up barriers to prevent free trade and turned inwards in an attempt to save those economies. Economic nationalism led to trade Wars and later World War.

Moral of the story: human memory is very short

In the 80s and 90s and 2008 faith in the free market had revived and as optimism returned many of the financial regulations which Roosevelt had introduced were felt to be outdated and were slowly dismantled. Yet again a lightly regulated market allowed speculation to grow unchecked. The hope is that such steps will work but the lessons from the crash of 1929 are that history repeats itself that human folly and greed are much stronger forces in financial affairs than reason and restraint.